Instant Finance Apply For A Personal Loan New Zealand : instantfinance.co.nz

Name of the Organization : Instant Finance Limited

Type of Facility : Apply for Personal Loan

Country : New Zealand

Website : https://instantfinance.co.nz/

| Want to comment on this post? Go to bottom of this page. |

|---|

Instant Finance Applying For A Personal Loan

We provide personal loans between $200 – $20,000 with a fixed interest rate for the term of your loan. Loan terms are normally over a maximum of 3 years and we encourage you to visit our rates and fees page.

Online Loan Application Form

** To apply for a loan, please complete this form. Fields highlighted with a red asterisk must be completed in order to continue with your online loan application.

** You will need to accept the terms and conditions at the bottom and click “submit application”.

** Please be aware that additional information and verification of information may be required to complete your online loan application.

** If you require any assistance please call us on 0800 26 00 00.

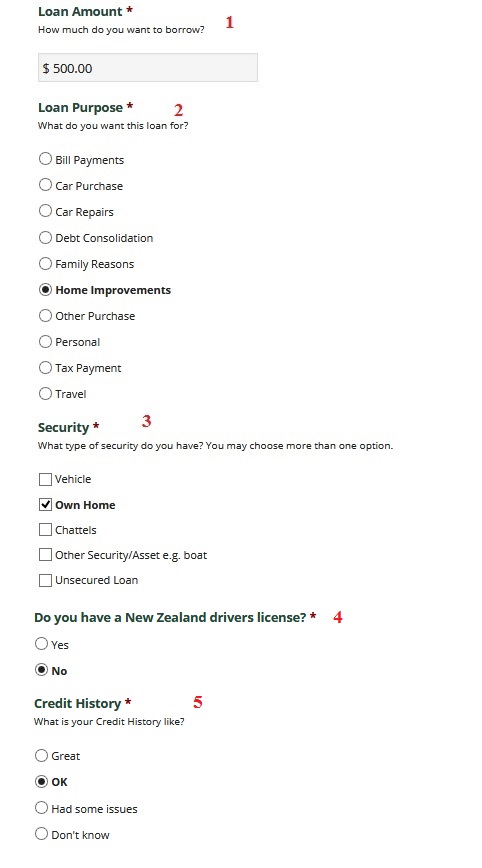

Enter the following details :

1. Enter Loan Amount*

2. Select Loan Purpose* [Bill Payments/Car Purchase/Car Repairs/Debt Consolidation/Family Reasons/Home Improvements/Other Purchase/Personal/Tax Payment/Travel]

3. Select Security* Option [Vehicle/Own Home/Chattels/Other Security/Asset e.g. boat/Unsecured Loan]

4. Do you have a New Zealand drivers license?* [Yes/No]

5. Credit History* [Great/OK/Had some issues/Don’t know]

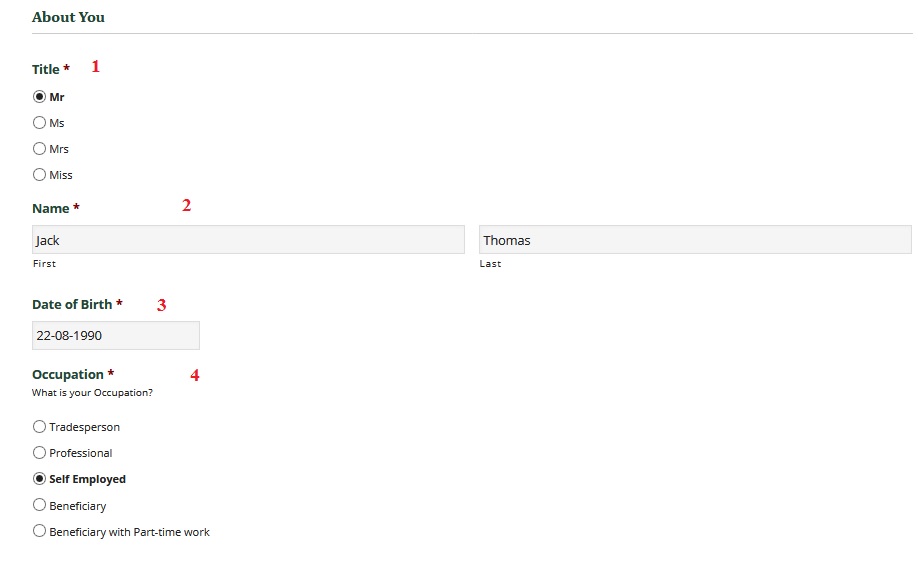

Personal Details :

1. Select Title*[Mr/Ms/Mrs/Miss]

2. Enter Name* First/ Last

3. Enter Date of Birth*

4. Select Occupation* [Tradesperson/Professional/Self Employed/Beneficiary/Beneficiary with Part-time work]

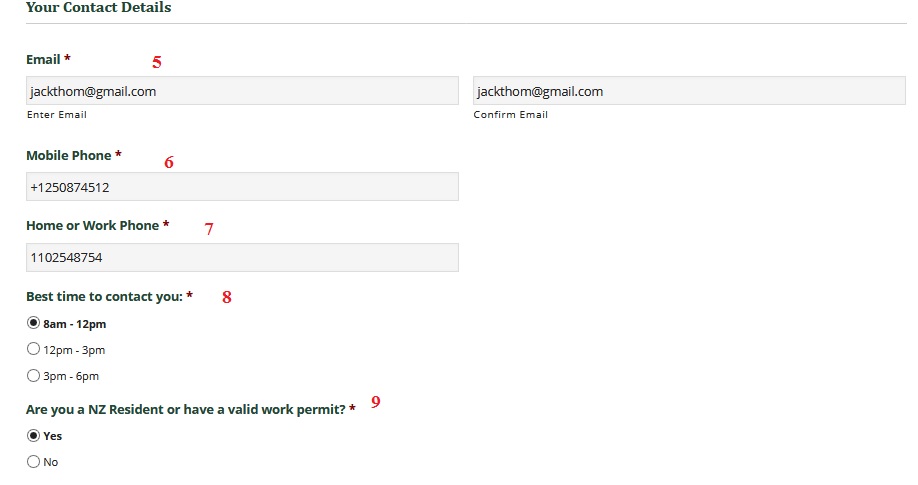

Contact Details :

5. Enter Email*

6. Re Enter Confirm Email

7. Enter Mobile Phone*

8. Enter Home or Work Phone*

9. Best time to contact you* [8am – 12pm/12pm – 3pm/3pm – 6pm]

10. Are you a NZ Resident or have a valid work permit?*

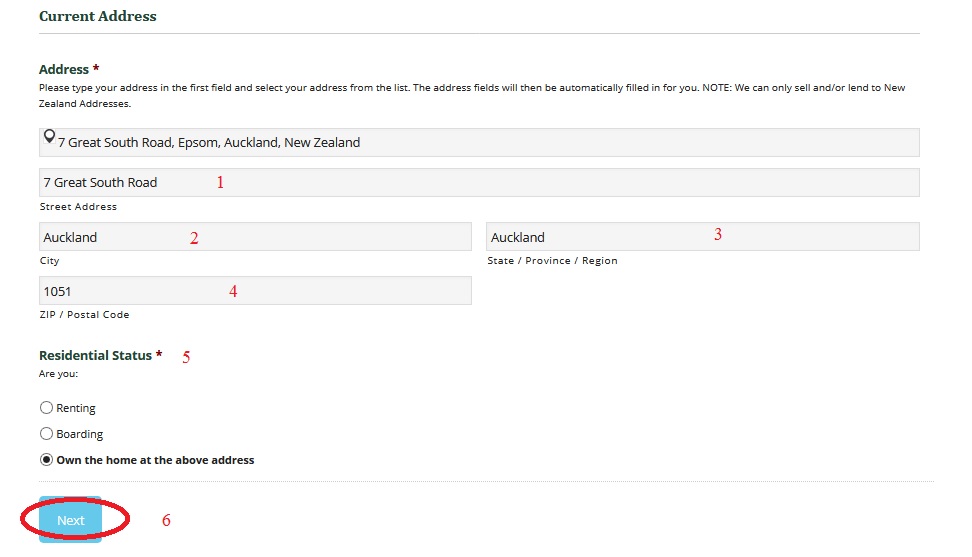

Current Address :

1. Enter Address*

2. Enter Street Address

3. Enter City

4. Enter State / Province / Region

5. Enter ZIP / Postal Code

6. Select Residential Status* [Renting/Boarding/Own the home at the above address]

7. Click on next button.

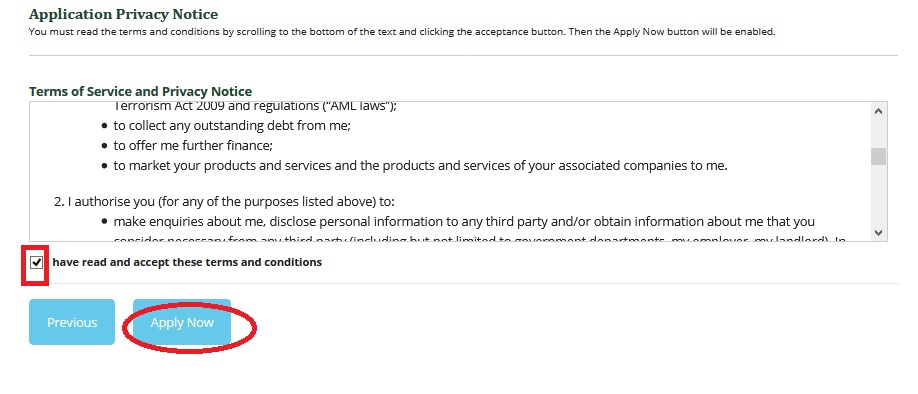

Fill all the further details then read all the instruction and tick the check box.Click on apply now button.

Schedule of Rates & Fees

Interest Rates :

** Instant Finance provides loans at an annual interest rate from 19.95% to 29.95% per annum.

** The rate that applies to your loan will be based on a range of factors including your circumstances, credit history with us or others, the security you can provide and the loan amount.

Loan Terms :

** Loan terms are normally over a maximum term of three years.

Fees :

| CREDIT FEES | EXPLANATION / COMMENT | |

| ESTABLISHMENT FEE | A CONTRIBUTION TOWARDS THE COST OF ASSESSING AND PROCESSING APPROVED LOAN APPLICATIONS. | |

| $0.00 to $500.00 | $100.00 | Fees are calculated based on the complexity of loans and only on the NEW money component. |

| $500.01 to 1,000.00 | $190.00 | |

| $1,000.01 to $3,000.00 | $300.00 | The fee is then determined by reference to the bands as shown. |

| $3,000.01 to $10,000.00 | $400.00 | |

| $10,000.01 to $20,000.00 | $500.00 | i.e. There is no fee for any refinance portion of an existing loan from Instant Finance. |

| $20,000.01 and greater | $600.00 |

Frequently Asked Questions

Can I apply for a personal loan if I am unemployed?

Yes, you can. We will complete a household budget and align your repayment schedule with your benefit or other income to make sure you’re not over-extending yourself. We will also look at the security you may be able to provide, check your credit record and make an overall assessment of your suitability to borrow, just like every application we assess.

Can I apply for a personal loan if I am a beneficiary?

Yes of course you can. We will complete a household budget and align your repayment schedule with your benefit income to make sure you’re not over-extending yourself. We will also look at the security you may be able to provide, check your credit record and make an overall assessment of your suitability to borrow, just like every application we assess.

What is the minimum age for applying for a personal loan?

You must be at least 18 years of age at the time application for any loan.

Can I apply for more than one personal loan?

Yes you can apply for a new loan while an existing loan is already in place with us. You may choose to refinance the existing loan and combine this with the additional amount you need, or you may apply for a separate loan.

We will consider your ability to operate either a single larger loan or two separate loans as part of our loan assessment. This would be based on your circumstances, affordability, security, credit record and historical loan conduct.