Alabama Revenue Dealer License & Plate Requirements : revenue.alabama.gov

Organisation : Alabama Department of Revenue

Service Name : Dealer License and License Plate Requirements

State : Alabama

Country : United States of America

Website : https://revenue.alabama.gov/motor-vehicle/dealer-license-and-dealer-license-plate-requirements/

| Want to comment on this post? Go to bottom of this page. |

|---|

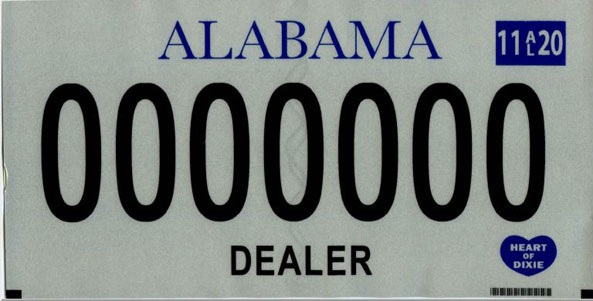

Alabama Dealer License Plate Requirements

This is a summary of information regarding the requirements to obtain Alabama dealer licenses and dealer license plates. Information presented contains all changes in Act 2014-158.

Related / Similar Post : MPDC License to Carry a Handgun

Obtaining Motor Vehicle Dealer License

Applications for an Alabama dealer regulatory license must be submitted to the department electronically. To apply: Visit the Motor Vehicle License Portal. Upon submission of the license application, a transmittal sheet will be provided that lists which documents must be mailed to the department.

Who is required to be licensed?

All new and used motor vehicle dealers, including motorcycle and trailer dealers (excluding trailers not subject to titling), wholesale dealers and rebuilders.

Dealer License Fees

** New motor vehicle dealer: $25.00

** Used motor vehicle dealer: $25.00

** Wholesaler: $25.00

** Rebuilder: $25.00

** Each additional place of business: $ 5.00

** Off-site sales license: $25.00

Bonding Requirements

1. All licensees are required to submit to the department a continuous bond in the amount of $25,000.

2. All new and used dealers are required by law to become designated agents of the department. The dealer bond also satisfies the designated agent bonding requirement.

Insurance Requirements

Each dealer must maintain blanket liability insurance coverage for all vehicles owned or associated with the business.

Minimum insurance limits are:

** $25,000 bodily injury/person/accident

** $50,000 combined bodily injury/accident

** $25,000 property damage/accident or a combined single limit of $75,000/accident

Obtaining Dealer, Dealer Transit and Manufacturer License Plates:

After the dealer regulatory license has been obtained, the dealer must visit the county licensing office to purchase the appropriate privilege license(s) (Sections 40-12-51, 40-12-62, or 40-12-169).Alabama license plates are purchased from the license plate official in the county in which the dealer is licensed to conduct business.

Who qualifies for each type of license plate?

Dealer (D) and motorcycle dealer plates may be obtained by licensed new and used motor vehicle dealers. Dealer transit (DT) and motorcycle dealer transit plates may be obtained by motor vehicle wholesalers, rebuilders, and new and used motor vehicle dealers. Manufacturer plates may be obtained by manufacturers of private passenger automobiles, motorcycles, trucks, truck tractors, or trailers, if the manufacturing facility is located in Alabama.

Dealer (D) and motorcycle dealer plate restrictions:

** New motor vehicle dealers may obtain a combined total of 25 dealer and motorcycle dealer license plates

** Used motor vehicle dealers may obtain a combined total of 10 dealer and motorcycle dealer license plates

** Licensed new or used dealers may purchase an additional combined total of 25 dealer and motorcycle dealer license plates if they complete applications for certificates of title for 1,500 or more title transfers in this state during the previous dealer regulatory license year.

Dealer transit (DT) and motorcycle dealer transit plate restrictions:

** Wholesalers and rebuilders may obtain a combined total of 10 dealer transit and motorcycle dealer transit plates.

** New or used dealers may also purchase a combined total of 10 dealer transit and motorcycle dealer transit plates.

There are no limitations on the number of manufacturer and motorcycle manufacturer plates that can be purchased by manufacturers.

What are the fees associated with the plates?

** Dealer: $26.00

** Dealer motorcycle: $18.00

** Dealer transit: $26.00

** Motorcycle dealer transit: $18.00

** Manufacturer: $26.00

** Motorcycle manufacturer: $18.00

Who may legally operate vehicles displaying dealer (D) plates?

** Prospective purchasers, limited to 72 hours of use

** Owners of the dealership

** Partners of the dealership

** Corporate officers of the dealership

** Employees of the dealership

Are there limitations on the types of vehicles the plates may be used upon?

** May be used on vehicles on temporary loan from a dealer to a customer whose vehicle is being serviced or repaired by the dealer.

** May be used on vehicles on temporary loan to a high school for the purpose of student driver education.

** May only be displayed on vehicles in the dealer’s/manufacturer’s inventory.

** May be used for one payload trip only on trucks or truck tractors in a dealer’s inventory with more than 2 axles on the power unit or a GVW exceeding 26,000 pounds. Limited to 72 hours of usage.

Note:

If the dealer charges customers a fee for the uses above, dealer plates cannot be displayed on the vehicle.New or used and wholesale dealers may display standard plates on vehicles in a dealer’s inventory. Ad valorem tax is not due when this occurs.